Today’s tight job market can wreak havoc on compensation strategy. On one hand, a business needs to provide a competitive compensation package in order to attract high performing talent. On the other hand, it’s extremely important to ensure your company is profitable and not over-paying for results. The struggle is real and it’s not uncommon.

We ended 2019 by helping one client strike the right balance. We started by reviewing the compensation payout and compared it against the profit margins of each project. The numbers on a P/L statement proved to be quite enlightening and they revealed that some projects, throughout the course of the year, actually ended up losing money. The usual suspects were to blame: scope creep, underestimating real costs, and inefficient processes.

All of these issues require attention in order to turn profitable results, but the double whammy for our client was discovering that sales incentives were paid for unprofitable business, resulting in the organization taking a double hit to the bottom line.

Our job was to get them on a profitable path which included finding a fair compensation structure for the sales talent that was also equitable for the business.

Are you getting what you’re paying for?

Your business isn’t on autopilot and your compensation plans can’t afford to be static either. Your commission structure is something that should be revisited on an ongoing basis. Ask yourself if you’re incentivizing the right amount for the right activities.

To start, be sure to establish a benchmark salary, plus a commission percentage that is standard in your specific industry. You must make sure this is aligned with revenue received and profitability. Every sale (service, product, project, etc.) is different, so be sure to review this on an annual basis to make sure you’re doing it right across all salespeople and channels.

Here are 3 simple steps you can take to make sure you have compensation and company profit alignment:

- Compare your compensation for sales talent (on an individual basis) to the revenue that each salesperson brings in;

- Go back several years and look for trends on what you paid in compensation versus the cost required to complete the sale (service, product, project, etc.), and determine if you received the benefit you paid for;

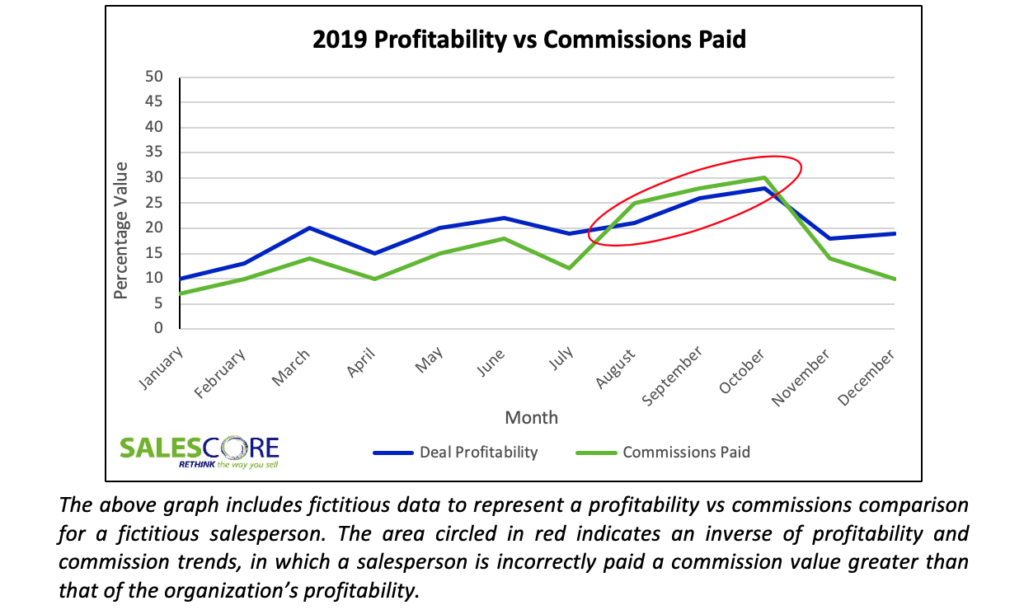

- Finally, look at the profit line of the customer and compare it to the commission you are paying the salesperson and establish a trend line. If the profit line and the compensation line start to come too close together, or worse, inversely cross, this can indicate a problem (see graph below).

At SalesCORE, we can help you align your compensation strategy with profit margins to ensure your organization wins on profitable business and retains ideal team players. The first step to a successful compensation strategy is to begin the dialogue. Let’s connect!